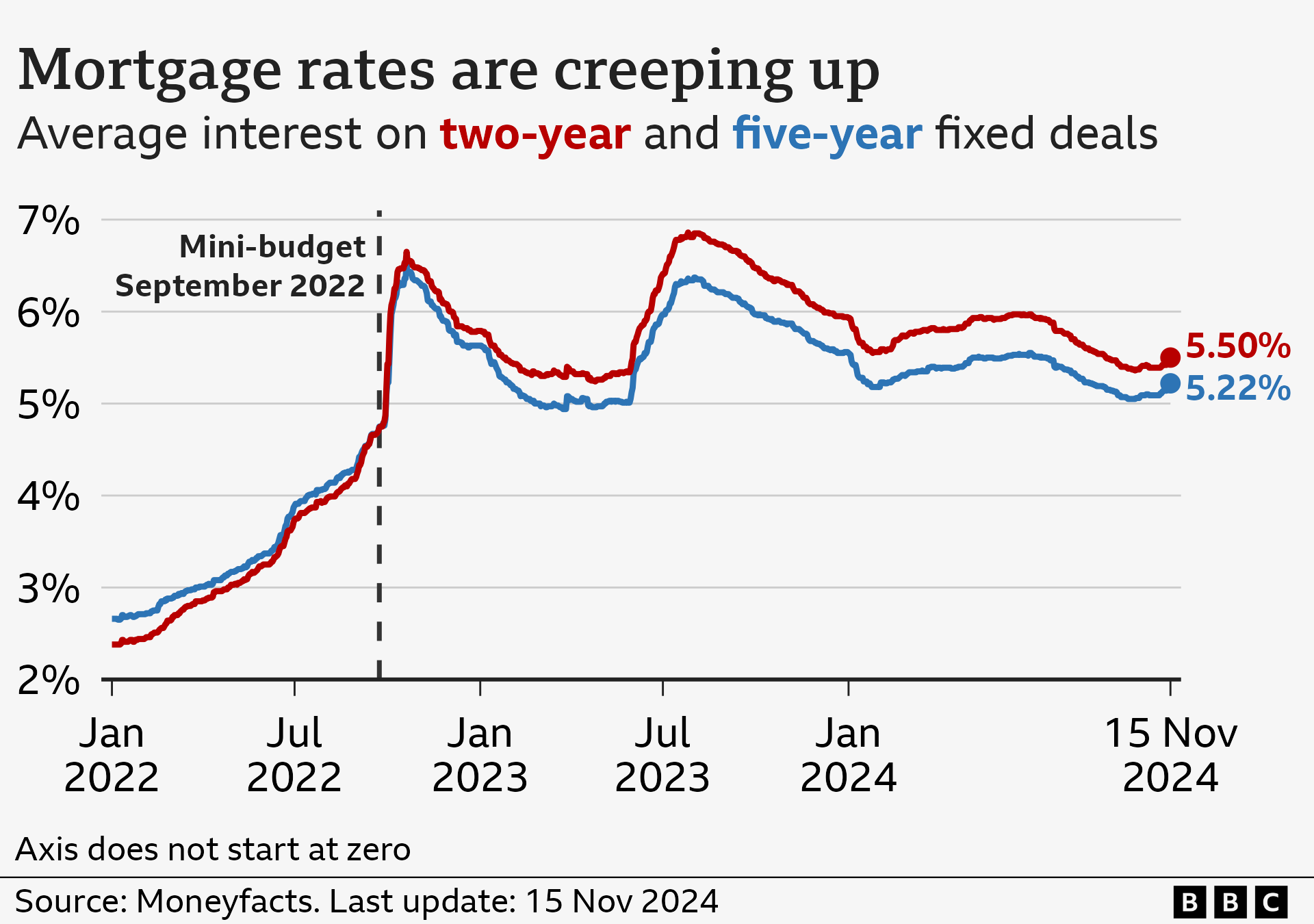

Mortgage costs are rising - with the average rate on a two-year fixed deal now at 5.5% - despite a recent cut in interest rates.

A string of lenders, including Barclays, HSBC, NatWest and Nationwide, have increased the rates charged on new fixed deals in recent days.

That has created a headache for borrowers hoping costs were on a consistent downward trend, especially in light of the Bank of England cutting the benchmark interest rate earlier this month.

Recent events, such as the Budget, mean that borrowing costs in general have increased, which may have a knock-on effect for those searching for a home loan.

How mortgage rates affect borrowers

Some tracker and variable rate mortgages move fairly closely in line with the Bank's base rate. However, more than eight in 10 mortgage customers have fixed-rate deals.

The interest rate on this kind of mortgage does not change until the deal expires, usually after two or five years, and a new one is chosen to replace it.

About 800,000 fixed-rate mortgages, currently with an interest rate of 3% or below, are expected to expire every year, on average, until the end of 2027.

Hundreds of thousands of potential first-time buyers also hope to get a place of their own with their first mortgage. All would welcome low mortgage rates.

There have been two significant spikes in the last couple of years, with the average rate peaking at 6.85% in August 2023, according to the financial information service Moneyfacts.

Rates are lower now, but the cost of deals has been moving up either side of the Budget.

The average rate on a two-year deal now stands at 5.5%, and the average on a five-year deal is 5.22%.

Nearly all of the cheapest deals on the market, often for those able to offer a large deposit, have risen back above a rate of 4%.

Why are interest rates down but mortgage rates up?

On 7 November, the Bank of England cut the base rate - which influences the wider cost of borrowing for businesses, individuals and the government - from 5% to 4.75%.

This had been widely expected, so the markets had already factored the cut into their calculations. In other words, it was so widely anticipated that borrowing costs had already been adjusted accordingly.

However, the Bank of England also said that future interest rate cuts may not come as often and as quickly as previously thought.

In the words of one mortgage broker, that was because the Budget delivered by Chancellor Rachel Reeves "threw a spanner in the works". Spending pledges risked inflating some prices, something high interest rates are designed to control.

Bank governor Andrew Bailey said rates were likely to "continue to fall gradually from here”, but cautioned they could not be cut "too quickly or by too much”.

Lenders price their mortgages not only on where interest rates are at any one time but where they, and the financial markets, expect them to be in the future.

Image source,Getty Images

Image source,Getty ImagesBrokers say the outlook had changed for lenders given the Bank's latest view on interest rates, prompting the most recent mortgage rate moves.

“The slew of rate changes in recent weeks has continued to push [mortgage] rates higher, reflecting the higher costs for lenders, as the market outlook for rates has edged toward a ‘higher for longer’ expectation," said David Hollingworth, from mortgage broker L&C.

"Unwelcome as it is for borrowers, it’s important to note that there’s no sign of rates skyrocketing as they have in recent years. The Bank of England base rate is still expected to fall over time, but markets are questioning if the pace will be as rapid."

A Treasury spokesman said that the Budget was "putting the public finances on a sustainable path" and that was "essential to ensuring steady mortgage rates for all homeowners".

What goes up might come down

The general trend of interest rates is expected to be down, but timing can be tough for borrowers.

That is made harder because mortgage deals currently have a relatively short shelf-life, owing to the uncertainty.

"Any stand out best-buy deals are not lasting very long," said Aaron Strutt, from broker Trinity Financial.

"If your mortgage is due for renewal and you are sticking with your existing lender, you need to keep an eye on the rates because the lenders don’t tend to tell borrowers when they are going up."

Ways to make your mortgage more affordable

-

Make overpayments. If you still have some time on a low fixed-rate deal, you might be able to pay more now to save later.

-

Move to an interest-only mortgage. It can keep your monthly payments affordable although you won't be paying off the debt accrued when purchasing your house.

-

Extend the life of your mortgage. The typical mortgage term is 25 years, but 30 and even 40-year terms are now available.

Source: BBC Website