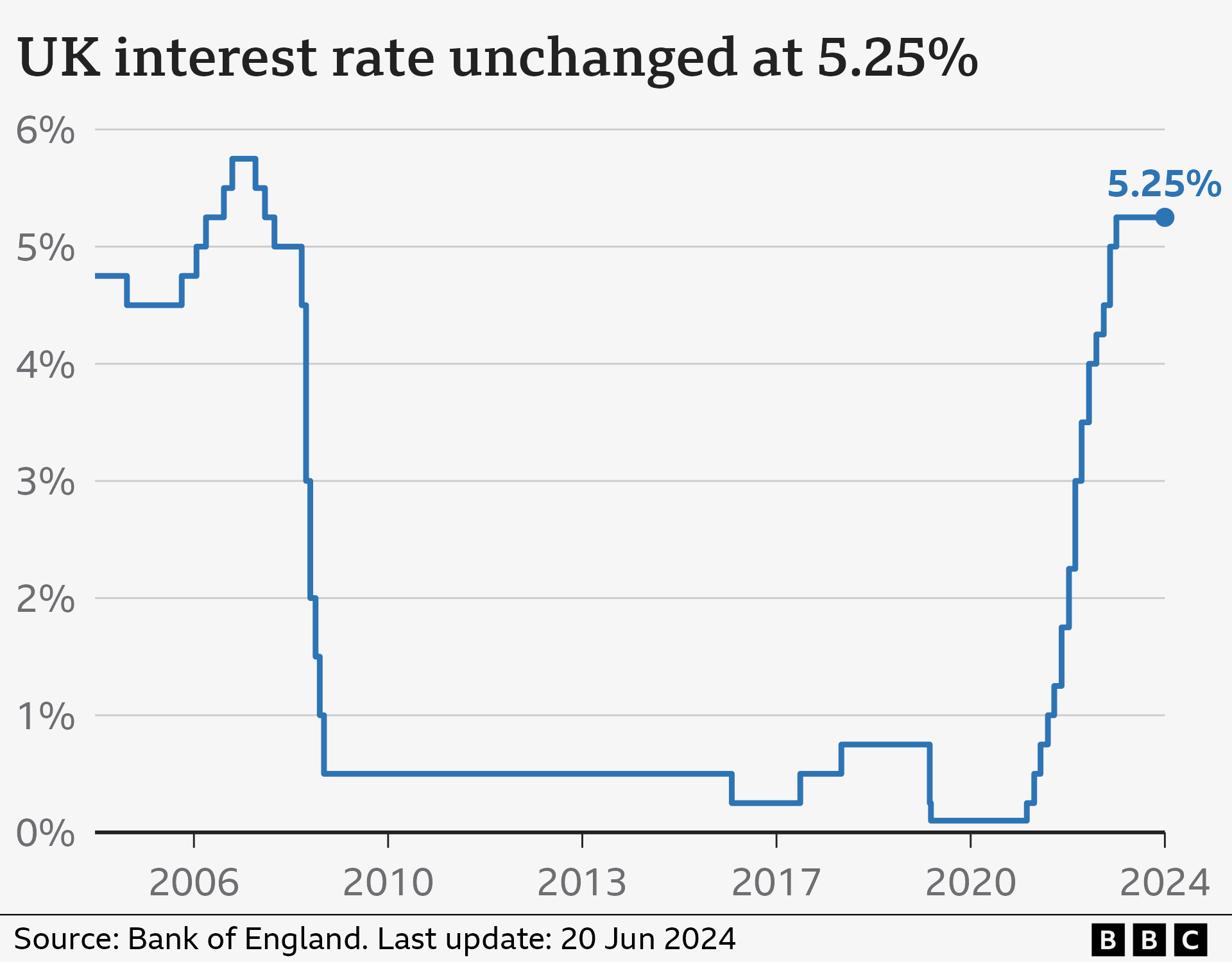

The Bank of England held interest rates at 5.25% for the seventh time at its June meeting, keeping them at their highest level for 16 years.

The pause follows a period of 14 successive increases, as the Bank tried to control inflation.

What is the Bank of England?

The Bank of England is the UK's central bank. It is independent of government but works closely with the Treasury.

It describes its key job as ensuring the UK has secure banknotes, stable prices, a safe banking sector and a resilient financial system., external

Why does the Bank of England change interest rates?

The Bank has a target to keep inflation - the official measure of how quickly prices are rising.

The headline Consumer Prices Index (CPI) inflation rate - which tracks the price of a typical basket of goods - has fallen from a high of 11.1% in October 2022 to 2% in May 2024.

This was the first time inflation has hit the Bank of England's target in almost three years.

The recent sharp increases in inflation were initially due to rising energy and food costs - largely caused by global events such as the war in Ukraine. But other factors - like wage increases in the UK - also helped keep prices high.

The Bank's traditional response to rising inflation is to increase the UK's official interest rate.

This affects the saving and mortgage rates which High Street banks and building societies charge individuals and businesses.

From November 2021, the Bank increased interest rates on 14 successive occasions to 5.25%, the highest level since February 2008.

The Bank has since held rates at that level seven times, most recently in June 2024.

Although the headline rate of inflation has now fallen to the Bank's target, other measures of inflation are still higher than it would like.

How does changing interest rates affect inflation?

Higher interest rates mean people have to pay more for their mortgages, for example, which means they have less money to spend on other things.

Fewer people wanting to buy things should, in theory, mean that prices rise less quickly.

It also makes it harder for firms to borrow money and expand.

Alternatively, if the Bank cuts interest rates, borrowing becomes cheaper, and people have more money to spend on other things.

This can encourage businesses and people to borrow and spend more, boosting the economy.

The Bank of England governor Andrew Bailey said he had seen "strong evidence" that the process to reduce inflation "is working its way through".

But he emphasised that the Bank had to be sure that having reached its 2% target, it would stay there.

The minutes of the Bank's June meeting suggest the first cut could come at its next meeting on 1 August.

How does the Bank of England change interest rates?

The Bank's Monetary Policy Committee (MPC) meets eight times a year to set rates.

Its nine members, external vote on whether to increase, reduce or hold interest rates.

Minutes of the meeting at which the decision was taken are also published. These show how the different members voted, and can gave some clues about future decisions.

Four times a year, the Bank also publishes a Monetary Policy Report,, external which sets out the economic analysis and inflation projections that the MPC uses to make its interest rate decisions.

The next report will be published alongside its August decision.

What else does the Bank of England do?

The Bank of England also buys and sells government bonds.

Bonds are a bit like an IOU from the government, which uses them to raise money to help meet its spending commitments.

In the period from the 2009 financial crisis until 2021, the Bank bought £875bn of government bonds. This was done through a process called quantitative easing. This was designed to reduce overall government borrowing costs, lower interest rates and stimulate spending in the economy.

The bank also announced an emergency bond-buying programme to try to stabilise the economy, after the September 2022 mini-budget caused turmoil on financial markets.

Once that intervention ended, the Bank said it would go ahead with a plan - first announced in August 2022 - to sell off some of the government bonds it holds.

What are the Bank's other responsibilities?

The Bank also:

-

produces banknotes and oversees credit and debit card payments

-

regulates banks and building societies

-

monitors risks in the UK financial system and acts to reduce them, like lending to banks if they need it. It shares responsibility for this with the Treasury and financial regulator, the Financial Conduct Authority

-

stores the UK's gold reserves, external - 400,000 bars worth more than £200bn - as well as those of other central banks.

Who runs the Bank of England?

Andrew Bailey became governor in 2019, having already worked at the Bank of England for more than 30 years.

Image source,Getty Images

Image source,Getty ImagesHe was the chief cashier from January 2004 until April 2011, which meant his signature appeared on billions of UK banknotes.

As well as being responsible for overseeing the Bank, the governor also chairs three important committees that help it work towards its targets: the Monetary Policy Committee, the Financial Policy Committee and the Prudential Regulation Authority.

Source: BBC website