-

The UK's main interest rate heavily influences the rates high street banks and lenders set for mortgages, meaning they tend to rise and fall in line with it.

Because the Bank of England has decided to cut rates to 4.75%, people with tracker mortgages - loans which track the Bank's base rate - can expect an immediate reduction on their monthly payments. There are about 600,000 people on a tracker deal.

But if you have a fixed mortgage deal, the rate you pay monthly in interest is fixed until the deal expires, so there'll be no change. However, the Bank warns many households who took out mortgages prior to the sharp rise in interest rates in 2021 are yet to face an increase in their mortgage costs.

If homeowners or buyers are shopping around for a new mortgage deal, rates might not change immediately given the cut today was widely expected and lenders price that into their offers in advance.

Banks will be closely watching at what the Bank of England thinks with regards to future rate cuts, as that will dictate what they do in the coming weeks and months.

-

'Let's wait and see' on potential US tariffs, governor sayspublished at 13:26

13:26 Image source,Reuters

Image source,ReutersOur own reporter Dearbail Jordan asks Bailey if he agrees with Donald Trump that "tariff is the most beautiful word in the dictionary".

Bailey, chuckles and responds: "I don't either have a favourite word or a most beautiful word in the dictionary...I'm not sure I'm going to join in that debate."

On a more serious note, he says "let's wait and see" on whether Trump decides to impose tariffs on goods being imported to the US, which he sees as a way of growing the US economy, protecting jobs and raising tax revenue.

The president-elect's pledge to impose taxes of 10% to 20% on all foreign goods could affect prices all over the world.

-

Reeves defends Budget, saying she had to make 'difficult decisions'published at 13:17

13:17Media caption, 01:02

01:02Chancellor Rachel Reeves welcomes decision to cut interest rates

Chancellor Rachel Reeves tells the BBC the cut to interest rates is "welcome news for millions of homeowners and businesses".

She acknowledges however, for many who took out mortgages a few years ago, they are still looking at higher rates.

She says the Conservatives caused "damage and chaos" to the economy, saying they were the "worst Parliament on record for living standards" and the news today is a "world away" from them.

On the Labour Budget that she announced last week, Reeves says she had to make "a number of difficult decisions" after saying she inherited a £22bn "black hole" in finances.

She adds that "our public finances are now on a firm footing" and the government now won't have to "come back with another load of tax increases".

-

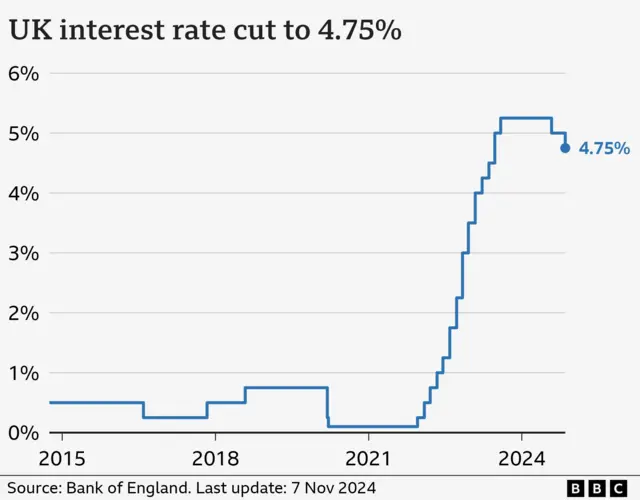

How interest rates look following the Bank's decisionpublished at 13:10

13:10

-

'We work with all US administrations' - Baileypublished at 13:02

13:02Dearbail Jordan

Reporting from the Bank of England Image source,Reuters

Image source,ReutersBailey will not be drawn on what Donald Trump has planned in terms of trade tariffs. He says that the Bank always respond to announced policies not stories on what they might do.

"We work with all US administrations. We worked with the previous Trump administrations and work with the current administrations."

-

Budget will push up inflation, but not to previous highspublished at 12:53

12:53Dearbail Jordan

Reporting from the Bank of EnglandSo, the million-dollar question – what will the Budget do to inflation?

Bank governor Andrew Bailey admits that there will be "some upward affect on inflation".

But he says it will take some time to learn that the full impact actually is. For example, it will be a while before we see whether higher National Insurance Contributions from employers mean higher prices and smaller wage growth.

However, Bailey points out while inflation will go up, it will be a world away from the level we saw in 2022, when it reached 11.1%.

-

'Don't undo our hard work,' new Tory shadow chancellor warns Labourpublished at 12:47

12:47 Image source,PA Media

Image source,PA MediaWe can bring you reaction now from Mel Stride, the new shadow chancellor.

He says the Bank of England's interest rate cut "will be welcomed by millions of homeowners and builds on the work the Conservatives did in office to hold inflation down".

"However, the independent OBR and the Bank of England set out that as a result of Labour’s choices in the Budget last week inflation will be higher. The government must not undo the hard work the last government did," he adds.

-

Today's rate cut could be the last this yearpublished at 12:38

12:38 Michael Race

Michael Race

Business reporterReaction to the Bank of England's decision is steadily streaming in.

It appears given the Bank is expecting inflation to increase slightly again over the next year to around 2.75%, it is expected rates are less likely to be cut again before next year.

Policymakers will meet again in December, but according to Thomas Pugh, economist at consultancy firm RSM UK, today's cut "will likely be the last" for 2024.

He says this is due to the government deciding to increase borrowing and public spending in the Budget, which is expected to increase inflation back above the 2% target.

Paul Dales, chief UK economist at Capital Economics, adds experts there "no longer" thinks rates will be cut quicker in 2025.

"We now think rates will fall only as far as 3.5% in early 2026 rather than to 3%. Overall, the UK Budget means that interest rates will fall a bit slower and not as far as we previously thought."

Source: BBC