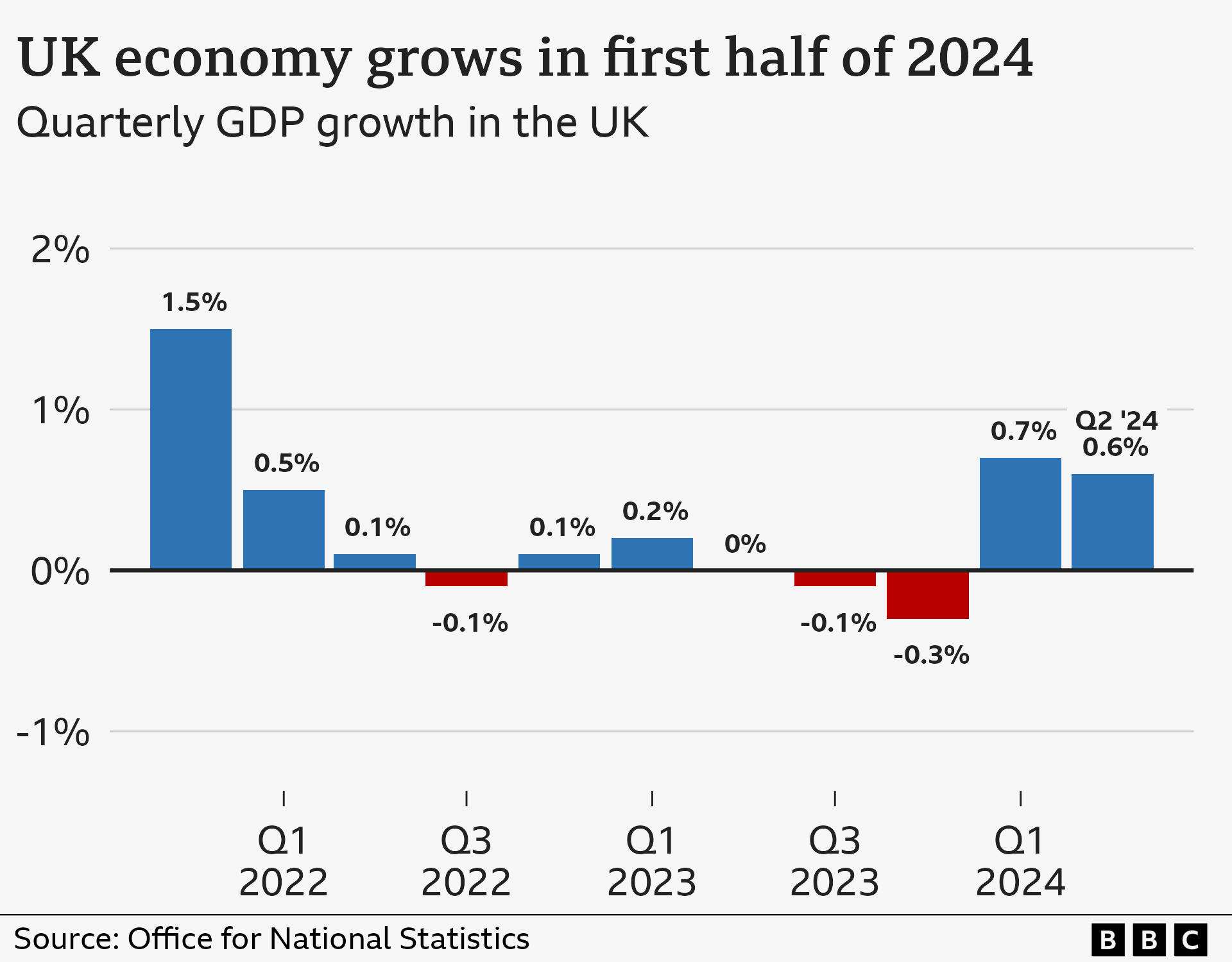

The UK's economy grew by 0.6% between April and June as it continued its recovery from the recession at the end of last year.

The latest figure was in line with forecasts and follows a 0.7% increase in the first three months of this year.

Growth was led by the services sector, in particular the IT industry, legal services and scientific research.

Services are the biggest contributor to the UK's economy, far outstripping manufacturing and construction, both of which saw output fall between April and June.

"The UK economy has now grown strongly for two quarters, following the weakness we saw in the second half of last year,” said Liz McKeown, director of economic statistics at the Office for National Statistics, which released the figures.

Last year, the UK economy fell into a shallow and short-lived recession.

A recession is defined as economic activity shrinking for two three-month periods – or quarters – in a row.

While gross domestic product (GDP) - a key measure of all the economic activity of companies, governments and people - expanded over the latest quarter, growth was flat in June.

While the services sector helped economic expansion over the three months, it was a drag on the performance in June alone.

Strike action by junior doctors affected growth. NHS England reported that 61,989 appointments were cancelled because of industrial action by junior doctors between 27 June and 2 July.

Economists also warned that growth might slow in the second half of 2024.

Anna Leach, chief economist at the Institute of Directors, said businesses were reporting modest activity for the summer months "no doubt affected by still high interest rates".

-

What is GDP and how does it affect me?

-

Published6 days ago

-

-

Inflation rate rises for first time this year to 2.2%

-

Published14 August

-

Earlier in August, the Bank of England trimmed interest rates to 5% in its first cut for four years.

“The challenge for government is to firmly lift the UK’s growth performance out of the doldrums," said Ms Leach.

"There’re no quick fixes here: we’ll need the government to follow-through on its manifesto commitments to set and stick with long-term infrastructure investment plans."

The economy was a key battleground in the general election which Labour won in a landslide after 14 years of a Conservative government.

Prime Minister Sir Keir Starmer pledged to take “take the brakes off Britain” and in the King’s Speech announced a number of plans, including changes to the planning system to make it easier to build houses and infrastructure.

Chancellor Rachel Reeves said: "The new government is under no illusion as to the scale of the challenge we have inherited after more than a decade of low economic growth."

But shadow chancellor Jeremy Hunt said that the GDP figures "are yet further proof that Labour have inherited a growing and resilient economy".

Image source,RNA

Image source,RNAMatthew Knight says falling interest rates may help the manufacturing sector

Activity in the manufacturing sector was mixed in the three months to June. While it was down overall during the quarter, there was growth in June.

Matthew Knight, commercial manager at RNA, a Birmingham-based firm which designs and make automation equipment, told the BBC: "Business is very good, we’re very busy. We can sell into different countries, if one area or country isn’t doing well, we can sell into another."

He said that business is picking up. "Interest rates falling might have something to do with it, because a lot of customers finance the equipment RNA makes, rather than purchasing it direct," he said.

The ONS data also revealed that output from the construction sector dipped by 0.1% between April and June as new building declined, though repair and maintenance work grew.

The ONS said that the pace of decline in the sector was easing, but a survey of businesses conducted by the Bank of England found that “any improving sentiment is not expected to translate to activity until later this year”.

Construction could be boosted if the Bank cuts interest rates again this year.

This week, new inflation data revealed that the rate had increased to 2.2% in the year to July.

That is higher than the Bank of England's 2% inflation target. However, inflation in the services sector - which the Bank also looks at when deciding on interest rates - continued to ease.

Capital Economics said that although the services sector grew between April and June "recent strength of activity won’t prevent further falls in services inflation".

It said it expects to the Bank to cut interest rates twice more this year to 4.5%.

Source: BBC website