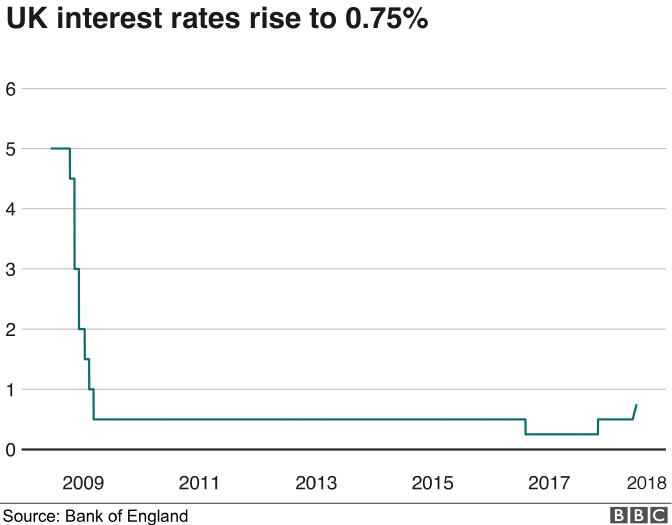

The Bank of England has raised the interest rate for only the second time in a decade.

The rate has risen by a quarter of one percent, from 0.5% to 0.75% - the highest level since March 2009.

The move will increase the interest costs of more than three-and-a-half million residential mortgages that have variable or tracker rates.

But it will be welcomed by savers, who could see a lift in their interest rates over the coming months.

However, after the last rate rise in November, half of savings accounts did not move at all.

Why are they doing this now?

The Bank's Monetary Policy Committee had been expected to raise interest rates in May, but held fire because the economy went through a weak patch at the start of the year - partly because of the harsh weather conditions, dubbed the Beast from the East.

Led by governor Mark Carney, the Bank is now confident that the dip was temporary and that economic growth will recover from the 0.2% rate seen in the first quarter, to 0.4% in the second quarter and maintain that pace later in the year.

Five interest rate facts

- More than 3.5 million residential mortgages are on a variable or tracker rate

- The average standard variable rate mortgage is 4.72%

- On a £150,000 variable mortgage, a rise to 0.75% is likely to increase the annual cost by £224

- A Bank rate rise does not guarantee the equivalent increase in interest paid to savers. Half did not move after the last rate rise

- No easy access savings account at a major High Street bank pays interest of more than 0.5%

The pick-up is being supported by household spending, which the Bank said had been "erratic" earlier in the year.

It is also believes the recent series of store closures on the High Street does not reflect a lack of appetite for shopping.

In its Quarterly Inflation Report, the Bank said: "Although in the past year the number of retail closures have increased and retail footfall has fallen, contacts of the Bank's agents suggest that mainly reflects shifts in consumer demand to online stores and from goods to services."

What is the outlook?

The Bank sees continuing "modest" economic growth of 1.4% this year and an increase to 1.8% next year.

The unemployment rate is expected to fall further from 4.2% and wage growth is expected to pick up.

Inflation is forecast to fall back to 2% - the Bank of England's target - by 2020.

The Bank sees some clouds on the economic horizon.

It said the outlook for the global economy was a bit gloomier, partly owing to the trade war between the US and China which has seen tariffs imposed on a range of goods.

Image copyrightGETTY IMAGES

Image copyrightGETTY IMAGES

It also highlighted a slowdown in the UK housing market this year, which has been "concentrated in London", where mortgage completions are down 12% on 2016.

But the Bank thinks that weakness might just be specific to the capital and may not say much about the prospects for the UK housing market as a whole.

What happens next?

The Bank is sticking to its guidance that interest rates will continue to head higher, but only at gradual pace and to a limited extent.

The financial markets have taken this on board and are forecasting one, and perhaps two, rises of 0.25% before 2020.

It also seems unlikely the UK will return to interest rates of 5% and above. In its inflation report ,the Bank published what it thinks is the natural interest rate for the UK economy.

It puts that at between 2% and 3%.

That relatively low rate is partly due to an ageing population.

Older people tend to save more and in the future, that will provide a greater pool of savings for lending to households and industry and help prevent the economy from overheating.

Source: BBC website, 02/08/2018 : https://www.bbc.co.uk/news/business-45043776