-

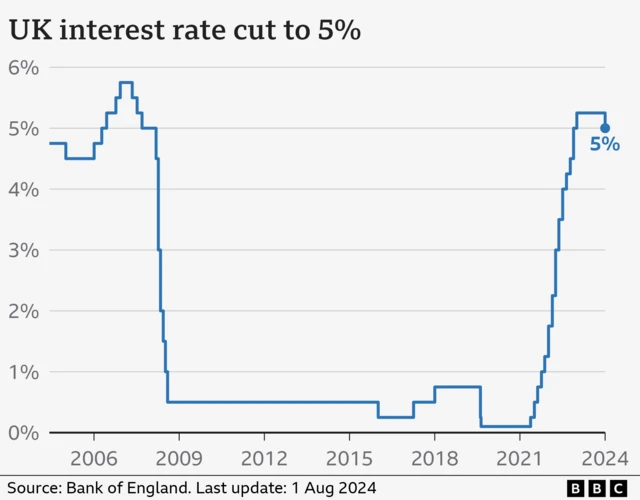

The Bank of England has cut interest rates from 5.25% to 5%, the first drop since the onset of the pandemic in March 2020

-

The BoE's rate setting committee voted by a majority of five to four to reduce the rate

-

BoE governor Andrew Bailey has indicated that despite today's announcement, it is unlikely there will be a flurry of interest rate cuts over the next few months

-

The Bank is forecasting that inflation will increase to about 2.75% later this year, before returning to its 2% target next year

-

Interest rates were hiked in the last few years in a bid to combat the pace of price rises, known as inflation

-

High rates have led to people paying more to borrow money for things such as mortgages and loans, but savers have also received better returns

-

Thanks for joining our live coveragepublished at 14:06 1 August

14:06 1 August Barbara Tasch

Barbara Tasch

Live editorWe are coming to the end of our coverage of the Bank of England's announcement to cut interest rates to 5% - the first cut to rates since March 2020.

As we have been reporting, despite the Bank's move, its governor has cautioned against cutting interest rates "too quickly or by too much".

The Bank is also forecasting that inflation will increase to about 2.75% later this year, before returning to its 2% target next year.

You can read more from economics editor Faisal Islam here and business reporter Dearbail Jordan here.

And to find out more about when mortgage rates might come down read on here.

-

Biscuitgate – a new hope?published at 14:01 1 August

14:01 1 AugustDearbail Jordan

Reporting from the Bank of England Image source,Getty Images

Image source,Getty ImagesThe Bank of England has, in recent months, rather been letting the side down in terms of the biscuits they feed us journalists.

They’ve been serving up the type of biccie normally found next to teeny-weeny kettles in mid-range travel taverns.

At the last interest rate meeting, ITV’s Joel Hill bravely raised the point with the Bank’s press team, going so far as to suggest they could perhaps rustle up a Jammie Dodger.

So I’m pleased to report that today the Bank came through and then some. Hill got a giant Jammie Dodger all to himself while the rest of the press pack was treated to a delightful assortment of biscuits. Long may it continue.

-

BoE committee strikes note of cautionpublished at 13:58 1 August

13:58 1 AugustDearbail Jordan

Reporting from the Bank of EnglandThe decision announced today by the Bank’s nine-member committee was finely balanced – five, including governor Andrew Bailey, voted for a quarter point cut.

The Bank’s chief economist Huw Pill was in the minority of four who voted to hold interest rates.

Commenting on the decision, Bailey said: “Inflationary pressures have eased enough that we’ve been able to cut interest rates today.”

But he struck a note of caution against expectations there would be a steady fall in borrowing costs.

“We need to make sure inflation stays low and be careful not to cut interest rates too quickly or by too much,” he said.

The inflation rate – which measures the pace of price rises for goods and services – hit the Bank’s 2% target in May and remained there in June

However core inflation, which strips out volatile elements such as food and fuel prices, remains comparatively high.

And the Bank expects inflation to rise in the second half of this year as energy costs tick higher in the colder months.

-

How will today's announcement impact mortgages?published at 13:50 1 August

13:50 1 AugustWhile homeowners with fixed-rate mortgages will see no immediate impact on their monthly payments, today's rate cut could still have an impact for some in the months ahead.

About 1.6 million homeowners have fixed-rate deals that will expire this year. Many of these deals will be relatively cheap as they were arranged before the Bank started to increase rates in late 2021.

As a result, many homeowners will be facing big increases in their monthly payments when they come to re-mortgage.

Some lenders had already cut their mortgage rates before today's move by the Bank of England, and there could be more to follow.

However, rates remain much higher than homeowners have become accustomed to for the past decade.

According to financial data firm Moneyfacts, the average two-year fixed mortgage rate as of this morning was 5.77%, and the average five-year rate 5.38%.

-

Reeves says public sector pay rises 'right thing to do'published at 13:26 1 August

13:26 1 AugustChancellor Rachel Reeves has defended public sector pay rises, saying it was the “right thing to do” after being asked whether it risked stoking inflation – the rate at which prices rise.

As we mentioned earlier, Rishi Sunak tweeted that the pay deals were putting more interest rate cuts at risk.

But Reeves said efficiencies she had found in government spending would help offset the impact of the pay increase on public finances.

-

Mortgage rates already lower than last year - Baileypublished at 13:13 1 August

13:13 1 AugustDearbail Jordan

Reporting from the Bank of EnglandWho will benefit more from the rate cut? Bailey says that average mortgage rates are around 1% lower than they were last year as financial markets projected that an interest rate cut was on the cards.

He says it will be interesting to see how the markets react today – will they forecast another trim this year?

UK Finance - the body that represents the main UK banks - has estimated that homeowners with a tracker mortgage will see monthly payments drop by £28 a month on average following today's cut.

Image source,PA Media

Image source,PA Media -

Will public sector pay deals have an impact?published at 13:08 1 August

13:08 1 AugustDearbail Jordan

Reporting from the Bank of EnglandRishi Sunak has just tweeted that public sector pay deals are putting more interest rate cuts at risk.

Bailey is asked about it but isn’t biting – he is looking ahead to the next big Treasury announcement which is the Budget on 30 October.

-

Interest rate cut 'too little, too late', Unite sayspublished at 13:07 1 August

13:07 1 AugustImage caption, Image source,PA Media

Image source,PA MediaUnite has over 1.2 million members

We've already heard from Chancellor Rachel Reeves and business groups and we can now bring you some more reaction, this time from one of the biggest trade unions in the UK.

Sharon Graham, the general secretary of Unite, calls the decision to cut interest rates "too little, too late" and urges a clear plan for future rate cuts.

"Interest rates still stand at historic highs and this small cut will offer little help to workers struggling with the cost-of-living crisis and record housing costs.

"Decisive action from both the Bank of England and Government is urgently needed, including a clear roadmap for future rate cuts and a programme of serious investment in our public services and industry to get us out of this crisis," Graham says.

-

Rate cut will give firms 'breathing space'published at 13:04 1 August

13:04 1 August Image source,Getty Images

Image source,Getty ImagesBusiness groups have been welcoming news of the rate cut.

"Today's decision by the Bank to cut the interest rate gives many smaller firms welcome breathing space and could trigger an increase in investment as borrowing costs decline," says the British Chambers of Commerce.

“A cautious and well-communicated approach from the Bank will support business confidence, which has been steadily increasing in recent months," it adds.

Meanwhile the Institute of Directors says the vote will give "welcome relief to businesses and households squeezed by the high cost of finance".

-

'One and done'?published at 12:54 1 August

12:54 1 AugustDearbail Jordan

Reporting from the Bank of EnglandBank governor Andrew Bailey is asked if this interest rate cut is “one and done”? That is - will there be no more cuts after this.

He’s definitely not giving any clues on this, saying he has no view on path of rates and the Bank will decide from meeting to meeting.

-

Care needed over rate cuts - Baileypublished at 12:45 1 August

12:45 1 AugustAndrew Bailey adds to the message that it is unlikely there will be a flurry of interest rate cuts over the next few months.

“We need to put the period of high inflation firmly behind us," he says, and "we need to be careful not to cut rates too much or too quickly”.

The Bank is forecasting that inflation will increase to about 2.75% later this year, before returning to its 2% target next year.

-

We've come a long way, says BoE governorpublished at 12:39 1 August

12:39 1 AugustDearbail Jordan

Reporting from the Bank of England Image source,Dearbail Jordan/BBC

Image source,Dearbail Jordan/BBCBank of England governor Andrew Bailey says the UK has “come a long way” in tackling inflation – he’s not wrong.

Around this time last year, inflation was 8%, now it is 2%.

While it is set to tick higher again this year because of energy prices, it is not expected to hit the highs we've seen since Covid-19 and Russia’s invasion of Ukraine sent energy prices soaring.

-

Excitement mounts ahead of press conferencepublished at 12:31 1 August

12:31 1 AugustDearbail Jordan

Reporting from the Bank of EnglandIt hasn’t been this exciting for years! The press conference at the Bank of England is packed today.

Even though it wasn’t a certainty that the Bank would cut interest rates, all media sent journalists to cover the announcement.

Governor Andrew Bailey will be arriving shortly to explain why the Bank plumped for a rate cut. We’ll keep you posted.

-

Public sector pay rise will not majorly impact inflation - BoEpublished at 12:29 1 August

12:29 1 AugustDearbail Jordan

Reporting from the Bank of EnglandThe Bank noted that wage growth – which can inflame inflation - had slowed, but it continues to monitor it.

It does not expect a recent public sector pay rise promised by Chancellor Rachel Reeves to have a major impact on inflation.

Reeves confirmed wage increases of between 5-6% for public sector staff including NHS workers and teachers on Monday when she also claimed the Conservative government had “overspent” nearly £22bn and attempted to cover it up.

The Tories have refuted this, claiming that Labour is laying the groundwork for tax rises at the Budget on 31 October.

The Bank confirmed that it had been briefed by the Treasury about the figures on Monday morning before Reeves made her statement in the House of Commons.

It said that it was too late to include any effect from Reeves’ announcement on Monday – when she also scrapped a number of public spending projects – in its Monetary Policy Report.

-

Chancellor says rate cut is 'welcome news'published at 12:17 1 August

12:17 1 August Image source,UK PARLIAMENT

Image source,UK PARLIAMENT"While today’s cut in interest rates will be welcome news, millions of families are still facing higher mortgage rates after the mini-budget," Chancellor Rachel Reeves says after the Bank's rate cut announcement.

"That is why this government is taking the difficult decisions now to fix the foundations of our economy after years of low growth, so we can rebuild Britain and make every part of our country better off," she adds.

-

Don't expect a flurry of rate cutspublished at 12:12 1 August

12:12 1 August Faisal Islam

Faisal Islam

Economics editorThe clear message today was not to expect a consecutive series of cuts from here.

While there may be scope for a further reduction this year below 5%, perhaps in November, the governor of the Bank of England wants to avoid cutting “too quickly or by too much”.

Inflation is expected to creep back up from the target of 2% over the next few months.

Inflation in the service sector - which covers things like hotels and restaurants - remains high, as do wage settlements, although both are beginning to calm.

The Bank was briefed early on most of the chancellor’s spending announcements, including the above inflation public sector pay settlements. So far they seem relaxed, with insiders suggesting that it is private sector wages that set the benchmark for public sector ones, not the other way around.

The inflationary dragon is on the retreat, but is not yet totally vanquished.

One rate cut has been delivered, and they will slowly tiptoe their way to some more cuts over the course of the next year.

“Enjoy your summer, but don’t go wild”, appears to be the message to Britain’s consumers.

-

Narrow 5-4 vote in favourpublished at 12:08 1 August

12:08 1 August Faisal Islam

Faisal Islam

Economics editorIt was a narrow vote in favour.

A group of three committee members led by the Governor of the Bank of England, Andrew Bailey, switched their vote from hold to cut, giving a 5-4 majority in favour, compared with a 7-2 vote in June.

One of the members who voted to hold, Jonathan Haskel, will also be replaced by the next meeting.

The key split on the rate-setting committee is between those who think that with inflation at the Bank's 2% target, it is appropriate to reduce slightly the squeeze on the economy, and others who still fear there will be enduring inflationary scars from the recent energy and food prices shocks.

-

Rate cut at lastpublished at 12:05 1 August

12:05 1 August Faisal Islam

Faisal Islam

Economics editor, reporting from the Bank of EnglandThe rate cut has come at last.

This is more than just the Bank of England cutting its base interest rate for the first time in four years.

The cut will be seen as an important staging post as the economy starts to turn the corner on years of inflationary shocks.

There will be some relief for many homeowners and movers, although most are now stuck on fixed rate mortgages.

Businesses can start to anticipate cheaper investment funding. The government borrowing forecasts should start to improve.

Rachel Reeves might dare to believe that consumer confidence could start to turn positive.

-

Interest rates cut to 5%published at 12:00 1 August

12:00 1 AugustBreakingThe Bank of England has cut rates to 5%, marking the first drop since March 2020, which is likely to lead to lower mortgage repayment deals.

The Bank had held rates at a 16-year high of 5.25% since August 2023, as it attempted to tackle rising prices across the UK.

The last time rates were dropped was in the early days of the coronavirus pandemic, they were slashed to a record low of 0.1% in an attempt to boost the economy.

-

What’s in it for savers and spenders?published at 11:48 1 August

11:48 1 August Peter Ruddick

Peter Ruddick

Business reporterWhen we think about the impact that interest rates have on all of us, the first thought is often about mortgages.

But remember, the majority of people own outright or rent their home.

Private rents are at a record high. In theory, lower mortgage costs for landlords could be passed down to tenants. But market watchers think what's needed first is an increase in housing supply.

A rate cut creates both winners and losers.

Some savers are getting a fairly good deal which could become a bit less lucrative after midday. But anyone with a loan or credit card debt could, in theory, see their interest rates get a bit cheaper.

Source: BBC website